first doing of … (ever, in one’s life, in the new year, etc.)

The yen has been weakening, temporarily falling below 160 yen to the dollar. The yen has weakened so much that it is speculated that there may have been currency intervention by the Bank of Japan.

I was curious as to why the yen has weakened so much, so I summarized it as a memorandum. Personally, I do not go into details because I only need an overview and I am not an economic expert.

Why has the yen weakened so much?

Because both the dollar is appreciating and the yen is weakening.

Let’s break it down by short-term and long-term factors.

Short-term factor: policy rate difference between Japan and the U.S.

What are interest and policy rates?

First, interest rates refer to the costs or rewards incurred when lending and borrowing money.

And the policy rate is the short-term interest rate set by the central bank (usually for money lending transactions of one year or less).

When foreign investors buy the currency of a country with a high interest rate due to both the desire for higher returns and the expectation of profit from exchange rate fluctuations, money moves toward the country with the higher interest rate.

Seeking high return opportunities: Countries with higher policy rates generally offer higher yields on their financial assets (especially short-term government bonds) as well. Foreign investors often invest in the financial assets of countries with higher interest rates in search of higher yields than in their own countries.

Expectations of currency value appreciation: Currencies of countries with high interest rates may increase in value as more investments seek higher returns. Investors aim not merely to earn interest income, but also to profit from exchange rate fluctuations.

U.S. interest rate cuts are far off: crocodile mouth conditions

So, currencies of countries with high interest rates tend to appreciate, and the U.S. currently has very high interest rates, not only against the yen, but also against currencies around the world.

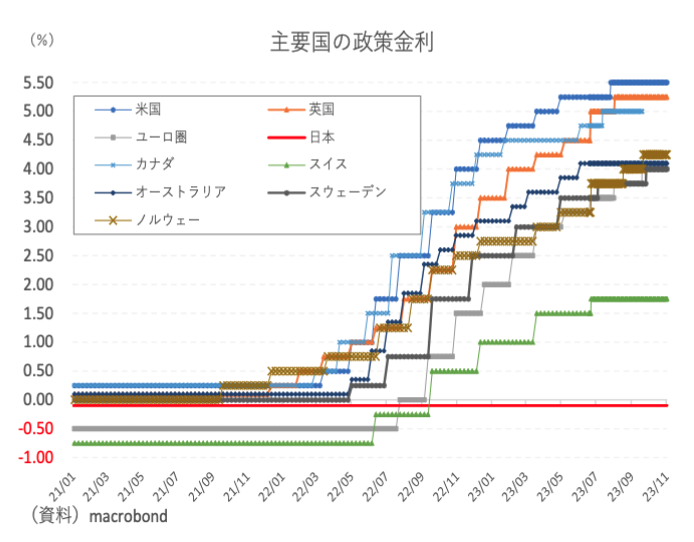

Since the U.S. lifted its zero-interest-rate policy in March 2022 and began raising interest rates, the interest rate differential between the U.S. and Japan has widened and the yen has weakened. This interest rate differential is known as the “crocodile’s mouth” because it is like an alligator opening its mouth.

So, the policy rate differential will not narrow until either the U.S. cuts rates or Japan raises rates, or at least one of the two.

However, Japan lifted its negative interest rate policy on March 19 of this year (-0.1% until then to 0.1% now), while in the U.S., the economy has been stronger than expected, so as of May 2024, the Fed’s rate cut timing is far off, and the current outlook is for one rate cut this year or later.

If you hold dollars, you get a high interest rate. On the other hand, the Japanese yen almost never earns interest. So the dollar is likely to be bought and the yen is likely to be sold for some time to come.

Why Japan Cannot Raise Interest Rates

The graph above shows that each country has raised interest rates since 2022, so why not Japan as well? However, there are also the following disadvantages, which make it difficult for Japan to raise interest rates.

- The Japanese government, which has been borrowing money for free, will suffer when interest rates rise. The government’s debt will also increase.

- Interest rates on loans to buy homes, cars, and business financing will increase. It will make it harder to buy new things, which could lead to a downturn in the economy. I would hope that salaries would have gone up as well.

- The possibility that the stock prices of Japanese companies will fall. Because raising interest rates will also raise interest rates on bonds, the relative merits of holding stocks will decline.

However, the disadvantages of raising interest rates are the same for other countries. Japan may be unique in having a large amount of government bonds (however, some argue that this is actually okay because Japan has a large amount of people’s savings).

Until now, Japan’s economy has not grown as expected and tax revenues have been insufficient. Therefore, the following economic policies have been implemented.

- Fiscal stimulus: Government issues bonds and uses the proceeds from the bond issue to invest directly in the economy and infrastructure (construction and repair of public infrastructure such as roads, bridges, schools, hospitals, etc.)

- BOJ’s low-interest-rate policy: Provides side support for economic revitalization by making loans available to businesses and individuals at low interest rates

As a result (at a cost?) The yen has depreciated.

Long-term factor: widening trade deficit

Nevertheless, this policy rate differential is a short-term factor, as it has been occurring since 2022. The long-term factor is Japan’s growing trade deficit.

As the trade deficit widens, the net outflow of funds from Japan to foreign countries increases, which in turn increases the supply of the home currency and depreciates the value of the currency. This directly leads to the depreciation of the yen.

Growing digital-related deficits

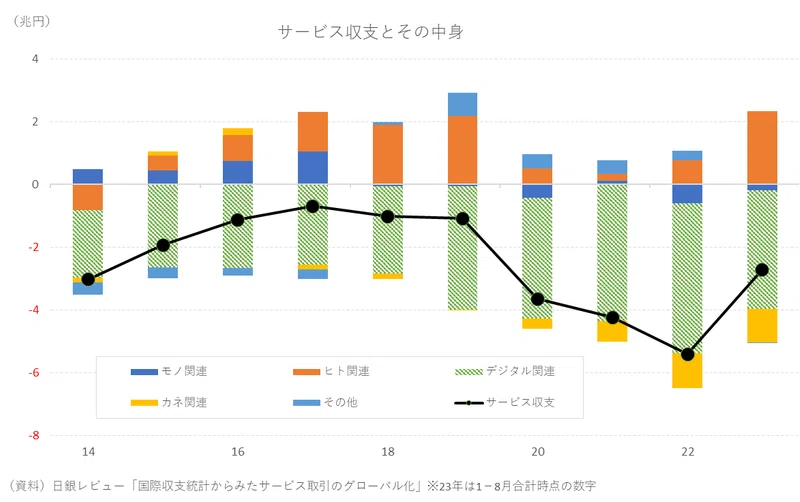

Below is a graph prepared by Mr. Karakama and Mizuho Bank, based on data from the Bank of Japan, showing the time series of the balance of services and its contents.

Payments for platform services and Internet advertising transactions by U.S. IT giants are increasing, and digital-related losses are growing. It has become a digital colony.

The surplus due to inbound (travel-related) activities (orange above: human-related) is offset by a deficit in digital-related income and expenditures, which is even more negative.

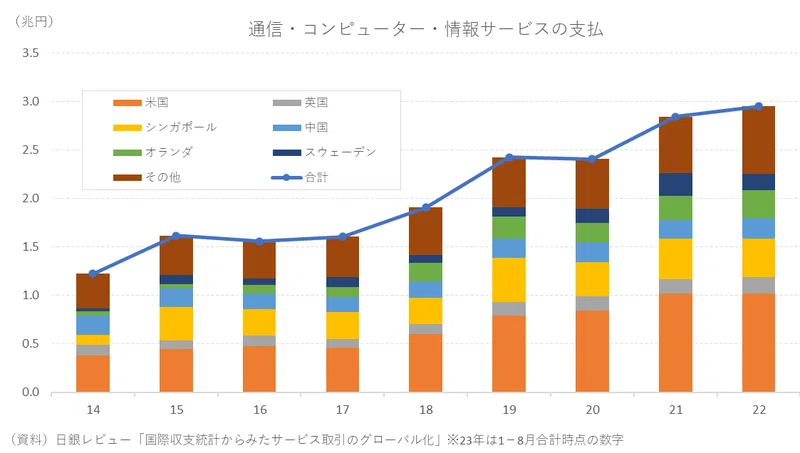

The United States, which accounts for 1/3 of the total digital-related balance of payments, leads the way, followed by Singapore, the Netherlands, and China. Payments to the US have nearly doubled in the last 5 years or so compared to 2017. Why is the Netherlands (Holland is most often associated with ASML, the semiconductor company, but does it go into digital?) I’m not sure.

Cloud-based IT services such as Zoom, Amazon, Netflix, Google, and FB are very strong in the US, and because they are IT services, they have low costs unlike the manufacturing services that Japan once dominated the world.

Unlike Japan, the U.S. is constantly raising prices through price revisions, so once a customer is captured by a platform, they are forced to pay more and more at the platform’s price.

At the end.

For my own understanding, I have tried to organize the most recent depreciation of the yen in terms of policy rate differentials and trade deficits.

As for the digital deficit, since digital is low cost and like crude oil, it would still be important to expand globally with digital services to earn foreign currency.

コメント