I was curious to find out how a late entrant could succeed in an area where large companies such as Skype and Google Hangouts had already entered and the market seemed to have matured.

Certainly, ZOOM is easy to use without the need to create an account, but Skype also did not require account creation from the beginning, and appear.in did not require account creation from the beginning, so I was curious as to why only ZOOM was so successful.

Moreover, compared to sharing services such as Uber and WeWork, which went public at the same time, the company is not listed in the red, but rather has turned a profit, which gives us the impression that it is well managed.

- Zoom 3Q 2020 Financial Results

- Success Factors for ZOOM’s Late Entry

- The founders felt challenged and had technical knowledge

- Focused on customer satisfaction

- Actively promoted collaboration with other services.

- Simple operation

- Focus on word of mouth without marketing in the early stages

- Actively invest in items where ROI is difficult to see

- Exposure to various channels

- Global expansion: Enter countries where some organic growth has occurred

- Pricing: Freemium model

Zoom 3Q 2020 Financial Results

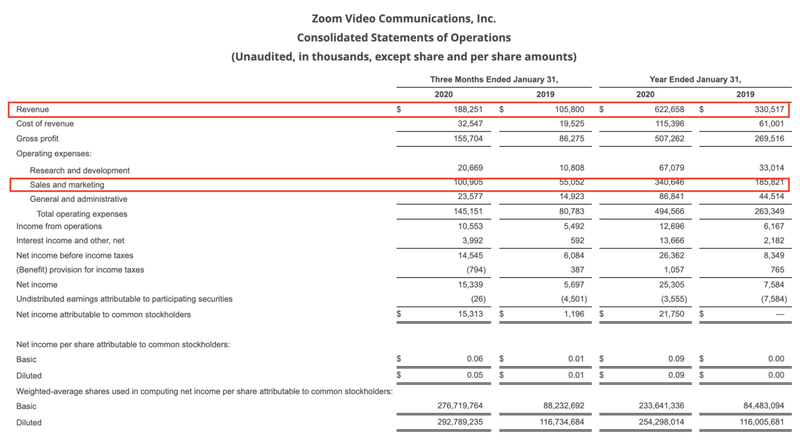

First, IR to 3Q2020 results

Sales: $166 million (≈18 billion yen) +85% y/y

Gross profit: $136 million (about 85% of sales)

Net income: $2.2 million (profit margin on sales: 1.3%)

As you can see, the gross profit is high because it is SaaS only.

The net profit is not so high, but that is because they are putting the money into investments. But the fact that the company finished in the black is impressive.

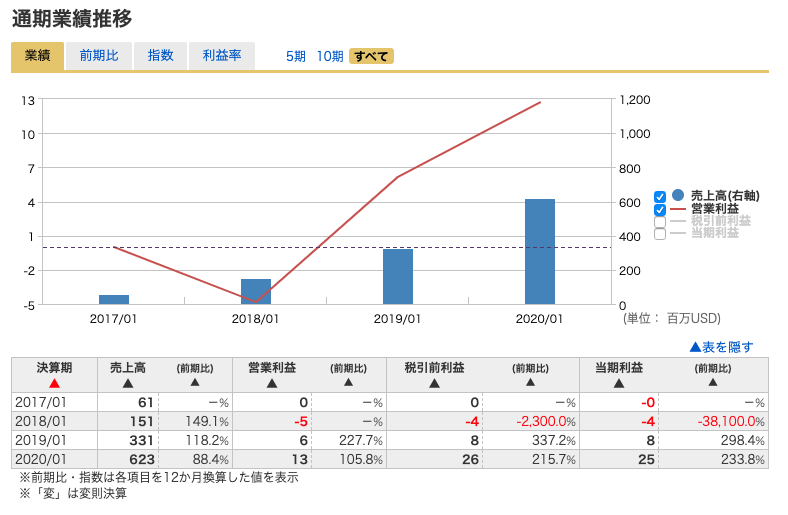

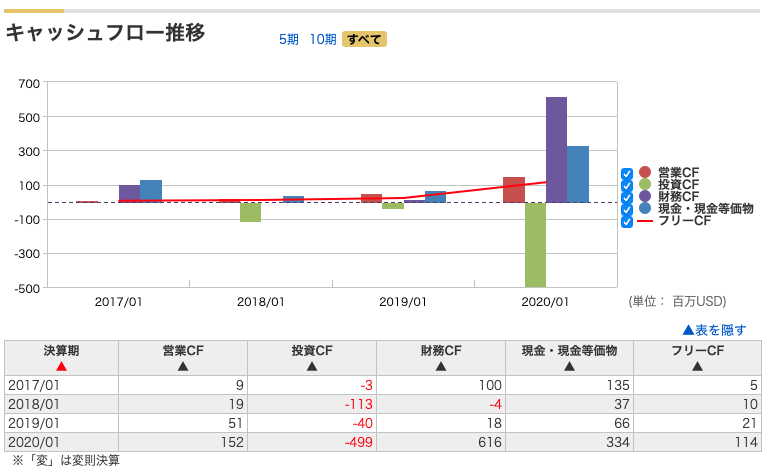

From Monex Stock Scouter U.S. Stocks

PL Details

It is interesting that the company spends more than half of its sales on SG&A expenses.

・ Development expenses are surprisingly low at less than 10% of sales.

→The company is in the process of developing a global market and is investing enormously in marketing to get in front of it. They also recently launched a sales partner program.

The amount of SG&A expenses required will vary depending on the phase of the product, but if you are spending about 50-60% of sales every year, it is likely that you are executing your marketing budget while working backwards to just barely end up in the black. It is better to invest in product promotion than to pay taxes. They are very strategic in this area. I have the impression that they are very good at using their money.

Also, I thought that SaaS would go viral by itself if it was convenient, but that’s not the case at all. Especially in the case of large companies.

Success Factors for ZOOM’s Late Entry

Organizational and strategic aspects

The founders felt challenged and had technical knowledge

Originally, I was the deputy director of the technical department of CISCO’s video conferencing tool, webex, and heard requests from customers that it was difficult to use. webex improvements were proposed within CISCO but rejected, so I became independent and developed a video tool that could solve customer issues. At that time, Cisco’s excellent engineers came along with us, so we already had the ability to develop video calls at the founding stage.

→We had the ability to develop the optimal solution for the video call we wanted to make from the beginning, more so than any other company. Within two years, 140,000 businesspeople were using the service.

Focused on customer satisfaction

They did not look at competing services that already existed, such as Skype and Google Hangouts, but focused on creating a service that would satisfy users.

The founder said in an interview, “We were confident that we could create a better service than Hangouts, Skype.” Even if you look at a service from the side and think it is the same as already existing services and do not enter the market, those who have actual experience in the field may have a different resolution of the issues. This is often the case.

service aspect

Actively promoted collaboration with other services.

It can be integrated with a significant number of apps, such as Calendar and Slack. Customers can use ZOOM in conjunction with the apps they normally use, so it fits into their workflow.

Simple operation

It is based on a simple UI, changing the functions displayed according to the user’s needs.

ZOOM has advanced functions that are necessary for use in webinars and require advance training to use these functions, but since these functions are unnecessary for general users, we have chosen not to display them.

→In developing a product, it is inevitable that it will gradually become multifunctional in response to customer requests, but this will lead to the dilemma of having too many buttons and not being able to tell where something is.

Beta Development

→Achieved PMF by unanimous approval

→Multi-functionalized according to customer requests

→Split plans into 3 levels (Basic, Standard, Premium)

→Simplify the UI at a glance to match the basic plan, and make the entrance gentle, but if you want to use the functions, you can set the advanced plan to display various cluttered functions and buttons.

I feel that the maturity of the product will follow the above.

marketing

Focus on word of mouth without marketing in the early stages

I asked the end users themselves to speak to ZOOM.

Also, due to the nature of the service, you can’t use it alone, so if you invite someone to a mtg and the other party is satisfied, that person will start using it during the next mtg, which was viral due to the nature of the service (but this is also true for other video calls).

Actively invest in items where ROI is difficult to see

After finishing SerisC in 2015, they hired their first marketing person and began aggressive marketing. At that time, the founders did not have a clear direction to develop this type of marketing, but because the founders understood the investment in marketing, they were able to listen to the marketing manager’s suggestions.

→At the time, a great product was already in place and retention rates were high, but initial service awareness was weak. So, we did A/B testing with multiple marketing channels. (top-of-funnel approach).

We also actively conducted marketing activities that were difficult to see the ROI, such as advertising at airports.

Exposure to various channels

High frequency of exposure across multiple marketing channels is critical in building a brand. In addition to constant updates on the product website, social networking sites, and YouTube, we used indoor and bus ads and radio in San Francisco to make sure that ZOOM was seen everywhere.

Global expansion: Enter countries where some organic growth has occurred

We decided to enter this market based on the number of accesses to our website, the number of registered users, and the number of searches in the video communication category, and chose a market that was already attracting interest.

First, we signed an exclusive contract with a company that would commit to sales regarding the Japanese rollout. The president of that company gave ZOOM licenses to all of its employees, and first let them know the advantages of ZOOM.

Then, one of the sales staff suggested that we use ZOOM not only for internal mtg sessions, but also for mtg sessions with people outside the company. The sales staff then suggested that they use ZOOM not only for internal mtg interactions, but also for mtg with people outside the company, and approached people outside the company who actually found it useful, leading to a ZOOM trial.

Pricing: Freemium model

The free plan is limited to 40 minutes, but can invite an unbelievable number of 100 people (perhaps this is a dare to be generous? With other companies’ services, it is limited to 10 people at most). There is no limitation on functions other than the time in the Free Plan.

Many people feel that the 40-minute time limit is a bit short for important meetings. They feel that they probably want an hour, so at the point when the 40-minute time limit arrives, they consider charging for the service. We designed the paid price so that the $15 monthly price tag feels very reasonable when considering billing. Compared to other services, it is both cheaper and more feature-rich.

The same is true of Slack, but the free version is not limited in its functionality, Slack’s inability to track the entire chat history. In this sense, I think Chatwork’s limit of 15 channels was not so bad.

In summary

The founder had a clear sense of the challenges and knowledge of the business domain

・The founder was thrifty and at the same time was able to make decisions to invest money where it should be spent at the right time (e.g., strategies to expand awareness in the growth phase after achieving PMF)

・Initially, the company focused on customer satisfaction and optimized PMF

I guess that’s what I’m trying to say. This should not be the only success factor, so we will look into it and add to it as needed. I have the impression that places where the president has good money management skills also have a stable management base.

I think it is interesting that with the emergence of ZOOM, the video calling domain seems to have fully matured, but then we see a sales-focused bell face emerging in Japan.

It is also interesting to see another angle emerge that is not just video calling, but offers the added value of data analysis to improve sales from the conversation.

As for the bell face, I thought this article makes sense.

He said that the resolution of the image doesn’t bother him much, but the audio interruption is a pain point, so he dared to make a phone call.

I wondered, but in fact, ZOOM also recently announced a “cloud phone system function for businesses” called Zoom Phone. I guess customers have been complaining about voice problems over the Internet, and they have decided to separate the voice from the phone as a separate product. Well, a fierce battle is inevitable. In the long run, I think the dominance of the telephone line will collapse with the advent of 5G.

I feel that when a platformer appears, it is always the next player to specialize in a domain and further optimize it there. So, we tend to think that because ZOOM has emerged, there is no more room for entry in this field, but the reality is that this is not the case.

We will continue to research companies of interest as appropriate and post as we see fit.

コメント