Introduction.

In a previous article on Melp’s review of its start-up, we described the Founder-Shareholder Agreement.

The Founding Shareholders Agreement must be in place “at the time of founding” because the heat between the founders may not continue to be the same for the foreseeable future. If it is not concluded at the time of foundation, it should be concluded at that time.

In this issue, I would like to describe how actually to create a founder-shareholder agreement while utilizing ChatGPT.

Download AZX template

Thankfully, the page of AZX, a company that specializes in startups and provides a wide range of legal, tax, accounting, labor, and patent support, has a template for a founding shareholders agreement, so download this PDF first.

Modified template using ChatGPT

Then, throw the following prompt to ChatGPT.

I want to enter into a founder’s agreement with a person named Mr. XX, who will hold XX% of the shares, based on this template.

I don’t think a vesting clause has been added for this one, so I would like to prepare a template with a standard vesting clause as well.

I would like the contract to be amended to be equal on both sides so that if I, as CEO, have to leave the company for any reason, Mr. XX can still purchase the company.

They did so and added a besting clause as follows.

Founding Member Shareholder Agreement

Mr. XX (hereinafter referred to as the “Executive Shareholder”) and [name of founder] (hereinafter referred to as the “Management Shareholders”) (Location of head office: ●; hereinafter referred to as the “Company”), which is owned by the Executive Shareholders, is a joint stock company ● (Location of head office: ●. (Location of head office: ●; hereinafter referred to as the “Company”) (Location of head office: ●; hereinafter referred to as the “Company”), as follows, and hereby enter into this Founding Members Shareholders Agreement (hereinafter referred to as the “Agreement”) as of the date indicated at the end of this document. (Location of head office: ●) (hereinafter referred to as the “Company”) as follows.

Article 1 Purpose

- The reason why the executive shareholders came to hold the Company’s shares is that the executive shareholders were expected to improve their motivation to contribute to the Company by enjoying the results of their faithful service as directors, corporate auditors (hereinafter referred to as “Officers”) or employees of the Company through the Company’s shares. The reason for the holding of the Company’s shares by the Executive Members Shareholders is that the Executive Members Shareholders were expected to be motivated to contribute to the Company by receiving the fruits of their faithful service as directors, corporate auditors (“Officers”) or employees of the Company through the Company’s shares, and the Executive Members Shareholders understand that if they lose their positions as Officers or employees of the Company, they will no longer have any reason to hold the Company’s shares. The officer/employee shareholders understand that they will have no reason to hold shares in the Company if they lose their position as an officer or employee of the Company.

- This Agreement, subject to the facts stated in the preceding paragraph, provides for the treatment of the Company’s shares held by the officer/employee shareholders and other matters.

Article 2 Transfer of Shares due to Loss of Status

- If an officer or employee shareholder loses his/her position as an officer or employee of the Company, regardless of the reason for such loss, the officer or employee shareholder shall, upon request from the Management Shareholder, transfer to the Management Shareholder or a third party designated by the Management Shareholder the number of shares of the Company held by the officer or employee shareholder (the “Shares Held”) that the Management Shareholder has designated. The Management Shareholder shall transfer to the Management Shareholder or a third party designated by the Management Shareholder, upon request of the Management Shareholder, the number of shares of the Company held by the Executive Member Shareholder (the “Owned Shares”) that the Management Shareholder designates.

- (2) In the case of the preceding paragraph, the transfer price per share of the Retained Shares shall be the same amount as the price for the acquisition of each such share of the Retained Shares by the officer/employee shareholder. However, in the event of a stock split, reverse stock split, issuance or disposal of shares by way of allotment to shareholders, or gratis allotment of shares by the Company after such acquisition, it shall be reasonably adjusted by the Management Shareholders based on the ratio of such split, reverse stock split or allotment.

Article 3 Vesting Clause

- The vesting period for the shares held by the officer/employee shareholders shall be four (4) years from the date of execution of this Agreement. During the vesting period, the officer/employee shareholders shall be entitled to acquire 25% of the shares each year.

- If an officer or employee shareholder resigns from the Company within the Vesting Period, the unvested shares shall be returned to the Company without compensation.

Article 4: Purchase of Shares upon Founder’s Resignation

- If a Management Shareholder resigns from the Corporation, the Officer Stockholders shall have the right to purchase the shares held by the Management Shareholder at market price.

- The purchase price shall be determined by a fair evaluation by a third-party organization based on mutual agreement.

If you wish to arrange a vesting clause

For example, try throwing the following prompt

This contract, if we have already worked together for a year or so, I think it would be acceptable to have the equivalent amount performed at the time of the contract. Also, can we make the post-cliff vesting on a monthly basis instead of a yearly basis?

Sure. We will take into account the portion of the year we have already worked with them for a year and make sure that portion is immediately vested at the time of signing the contract. It is also possible to change the post-cliff vesting from yearly to monthly. Below is the pertinent portion of the revised contract.

Article 2 Vesting Clause

- The holding of XX% of the shares of the Company by the officer and employee shareholders shall be vested on the following terms and conditions:

- Vesting period: 4 years

- Cliff duration: 1 year

- The first 25% is vested at the time of contract and then the remaining 75% is vested monthly.

- If an officer or employee shareholder resigns from the Company within the Vesting Period, the unvested shares shall be returned to the Company without compensation.

If you want to add an acceleration clause

Try throwing the following prompt.

If the sale were to take place in a shorter period of time than the vesting schedule, I would like to make the entire XX% invested in the officer/employee shareholders eligible for sale. Can you amend the agreement?

If the company is sold in less time than the vesting schedule and you want to give the directors XX% of the shares, you can do so by adding an “acceleration clause” to the contract, as follows

Acceleration clauses provide for the lump-sum vest of unvested shares upon certain events (e.g., a sale or merger of the company).

Below is sample language for an acceleration clause to be added to the contract.

Article 10 Acceleration Clause

1. in the event of a sale, merger, or other event whereby the company is acquired by a third party, the unvested shares of the officer and employee shareholders shall be immediately vested.

- In the event of a sale, merger, or other event whereby the company is acquired by a third party, the unvested shares of the officer and employee shareholders shall be immediately vested.

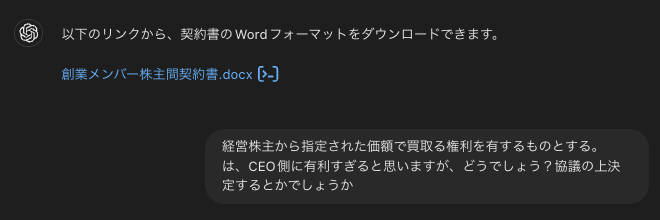

Have it output in Word format.

Once you have made the modifications and feel that you now have a model, the last step is to have it output in Word format.

Share the document you have created, have the other party review it, and when you reach an agreement, convert it to PDF, sign it electronically (CloudSign, DocuSign, etc.), and you are done.

summary

Because of GPT-4o’s high accuracy, it will be able to generate the appropriate language for the contract from the prompts, so it will be ready to go from creation to execution in about 30 minutes.

As for the pitfalls of the contract, it is advisable to know in advance (in this case, to allow the remaining members to buy out the shares if the founding member decides to leave the company + the purchase price at that time, etc.), of course, few people know everything perfectly.

However, even in that case, you can ask the GPT, “Are there any omissions in this contract? Please list any clauses that may cause problems after the contract is signed, and please add clauses to address them,” etc., and they will solve the problem.